Annual Report Integrated 2020

|

Message from the management |

Message

The year 2020 was a transformational one for SIMPAR and its subsidiaries. During the year, we completed our corporate restructuring and produced growth with higher profitability, even amid the context of the Covid-19 pandemic which tested and provided proof of the resilience and fundamentals of all our companies.

We emphasize that even amidst the challenges imposed by Covid-19, we put intensive work into making strategic movements in order to generate sustainable value for customers, shareholders, creditors, suppliers, employees and other stakeholders, while not losing focus of the quality of the services provided to our customers and the well-being of our employees and society.

Read more

|

SIMPAR |

About SIMPAR

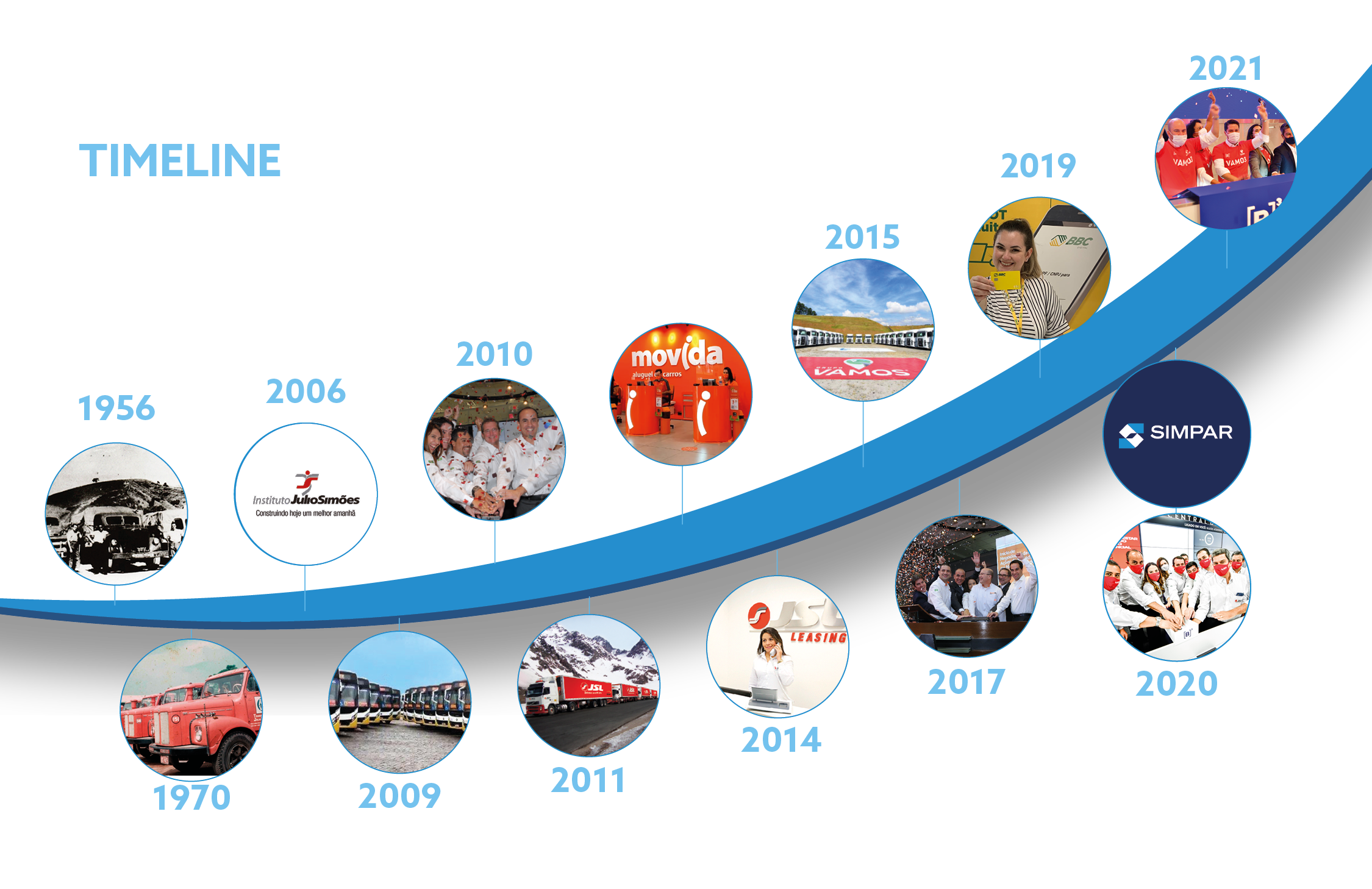

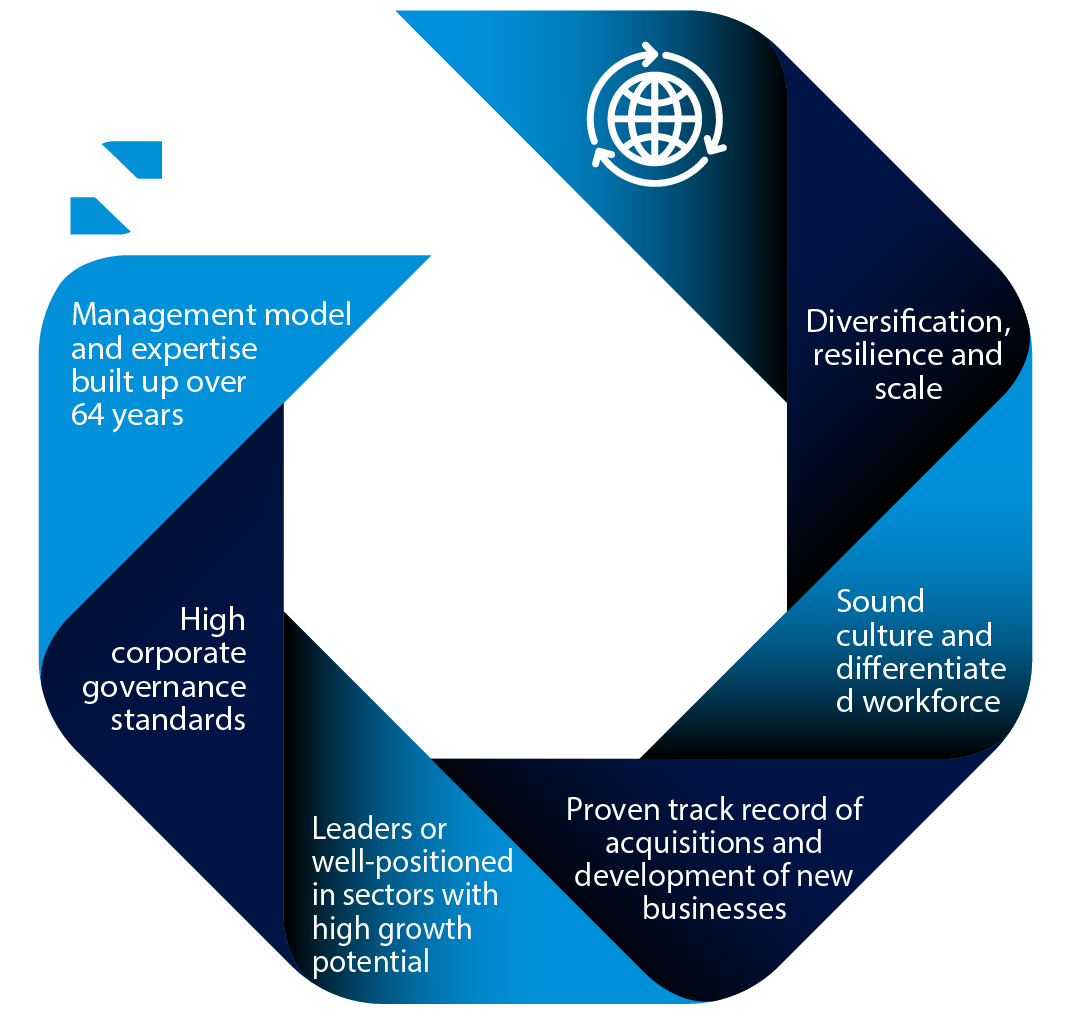

Founded in August 2020 following the corporate restructuring approved by the non-controlling shareholders of the JSL Group at the time, SIMPAR is a holding company that controls and manages six independent companies that are leaders or well placed in the segments in which they operate: JSL, Movida, Vamos, CS Brazil, Original Concessionárias and BBC Leasing & Conta Digital.

Read more

|

Value generation |

Capital management

The SIMPAR business model aims to measure and demonstrate how its managerial capacity and the businesses of its subsidiary companies affect stakeholders. It also demonstrates the ability of the holding company to create positive value over time. To that end, it shows the capital resources used as inputs (when the creation of value begins), the company's values and intangible assets (at the center of the model), and the positive impacts that the businesses and activities have (the value created based on the capital resources used).

Read more

|

Intellectual and organizational capital |

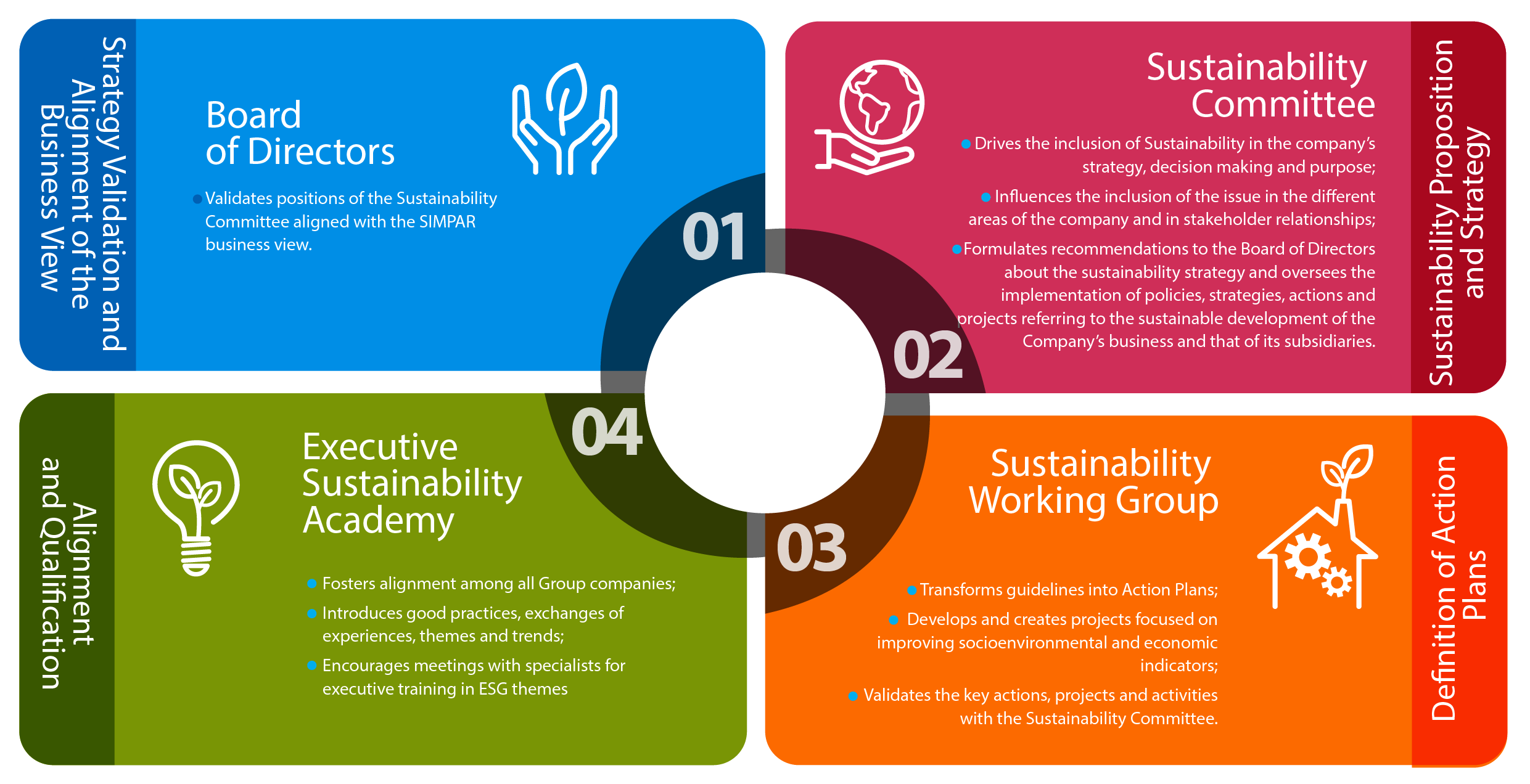

Strategic management

In every deal and relationship, SIMPAR bases its management on People, Culture and Values – a tripod structure which, rooted in best corporate governance practices and strong cash generation, represents huge potential for sustainable growth. The holding company has been structured to contribute, support and accompany the planning, execution and achievement of the targets of all subsidiaries, which have independent governance and boards of directors.

Read more

|

Human capital |

Employee management

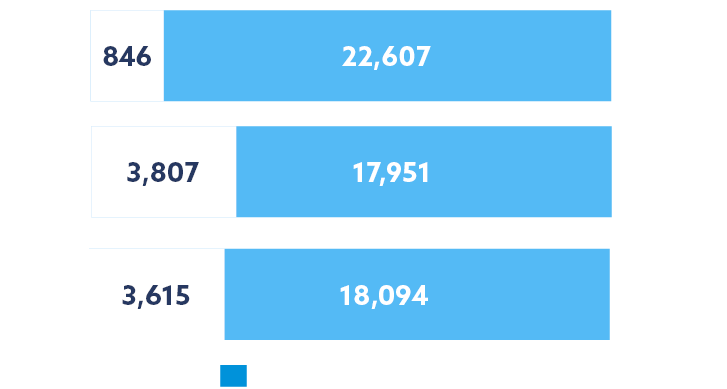

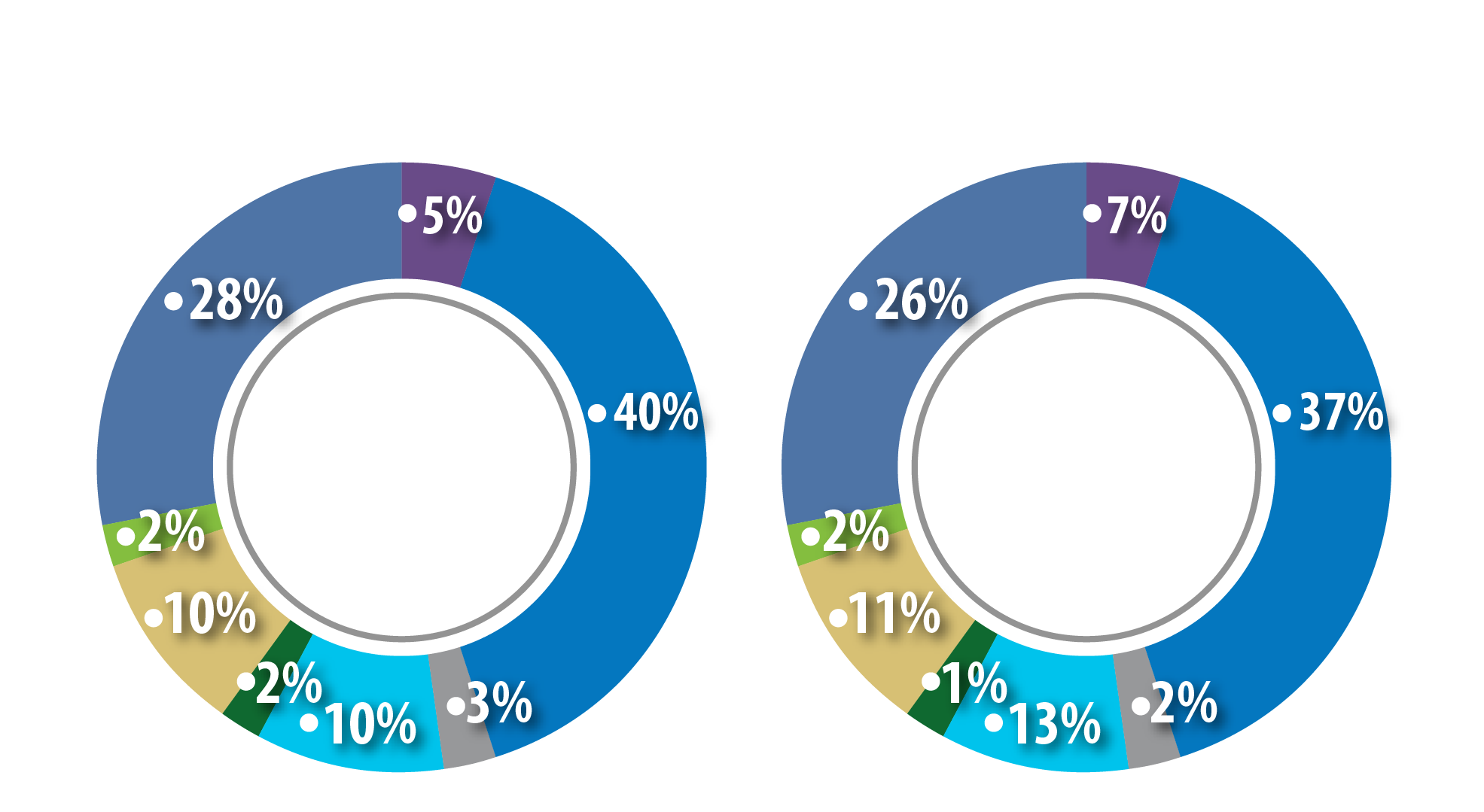

At the end of 2020, bearing in mind the subsidiary companies, SIMPAR had a workforce of over 21,000 of its own employees – of which 83% men and 17% women – and 844 outsourced staff. The search is for professionals who identify and embrace the values of the holding company, in order to ensure that the essence that facilitated the sustainable development of the business over recent decades is maintained.

Number of employees by gender

Read more

|

Social and relationship capital |

Supplier management

Following significant progress in managing the production chain in 2019, within the scope of the Supplier Management Project, in 2020 SIMPAR improved its supplier selection process by introducing vetting in which social aspects are evaluated. A further advance during the year was the corporate restructuring, with strong companies under the umbrella of the same holding company, guaranteeing a robust cash structure, security in its relations with suppliers and greater bargaining power.

The company conducts its business in a way that boosts the development of the states where its subsidiaries operate, for which reason partnerships with local companies receive priority. So much so that, in 2020, of total purchases and expenditures on services, 72% were with local suppliers (in the states where the Group’s branches are located). Besides this commitment, and with a view to maintaining the excellence of its production chain, SIMPAR requires its partners to adhere to socioenvironmental requisites, respect for human rights and high standards of labor and healthcare.

Read more

|

Natural capital |

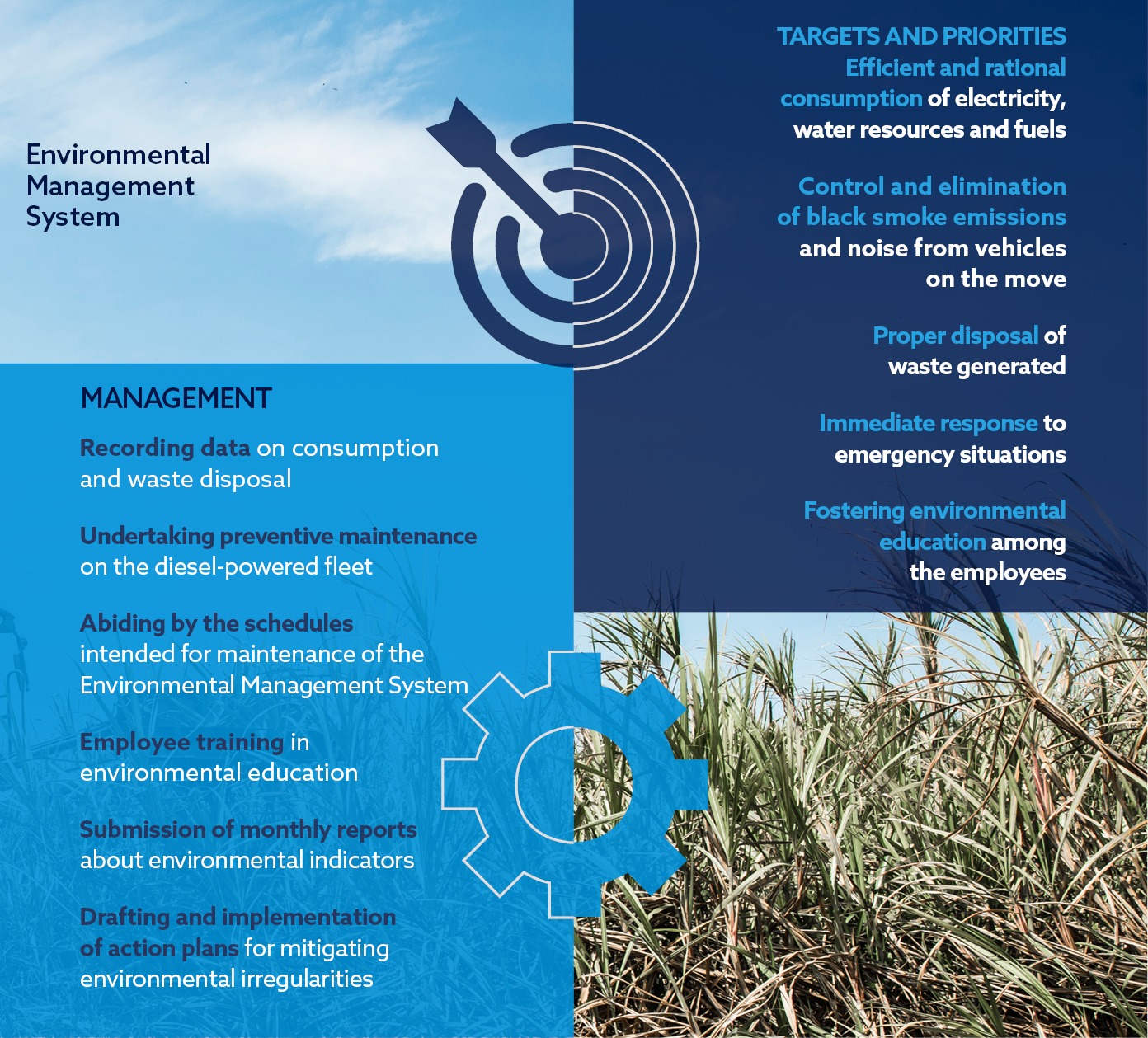

Environmental management

SIMPAR, in its activities as a holding company, causes no significant environmental interference. However, on account of the activities of the companies in the portfolio, the company maintains corporate processes, guidelines and programs that aim to mitigate adverse impacts on the environment and the adoption by its subsidiaries of best practices.

Read more

|

Financial capital |

Economic and financial performance

Focused on the sustainable generation of value and predicting a dynamic, constantly changing business environment, in 2020 SIMPAR continued to focus on the development of its subsidiaries operating in sectors with huge growth opportunities. The company has the expertise for defining investments and dividend policies for the entire portfolio, always in compliance with the applicable laws and regulations. Thus, during the year it booked record Consolidated Net Income and EBITDA, in addition to having registered Gross Investment of R$ 5.8 billion, of which R$ 3.4 billion in expansion and R$ 2.4 billion in renovation.

Read more

|

About this report |

Transparency in reporting

The Integrated Report of SIMPAR combines socioenvironmental, management and performance information of the holding company, which was created in 2020 following the corporate restructuring of the JSL Group. The document presents a consolidated picture of the key results of the six subsidiaries – JSL, Movida, Vamos, CS Brasil, Original Concessionárias and BBC Leasing & Conta Digital – and highlights the corporate management of over 21,000 employees.

Reflecting continuous transparency and evolution, the report was drawn up based on the most recognized global reporting practices, while the content followed a materiality process for presentation of the most important issues and information to SIMPAR’s stakeholders.

Read more

Annual Report |